If you are involved indoors which have an incident out of cabin temperature, the best treatments is to find on the brand new unlock street-or the discover h2o. The newest breeze in your tresses, this new jet on your own deal with, or even the miles rolling aside using your rims? Its over amusement. It’s therapeutic.

In the event the an auto represents liberty and you will utility, running a boat, cycle or recreational vehicles (RV) represents liberty and you will spontaneity. If you have done your research making smartly chosen options regarding your mortgage, it means obtaining antidote in order to perseverance and you will stress correct around on your own garage, available anytime.

The choice to acquire one shall be far from impulsive, not. There’s a lot to take on one which just commit. Amusement vehicles tend to you want special repair and fixes. You will want to think undetectable will cost you particularly sites and certification costs, insurance fees and you will required accessories.

After you determine this one suits you, the next phase is to search as much as-not simply for the the new automobile, however for the proper Camper, ship or motorcycle mortgage. Before you can perform, here are a few things should be aware of.

1. Credit unions will save you currency

Did you know you could financing their Camper with OCCU? There are lots of reasons to get your loan owing to a card union.

Because a don’t-for-finances, i purchase towards down charges and you can interest rates for our professionals. Actually a small reduced amount of their interest adds up so you’re able to a lot of money within the discounts across the life of a great vehicle loan. Here are a few our finance calculator to see the real difference on your own.

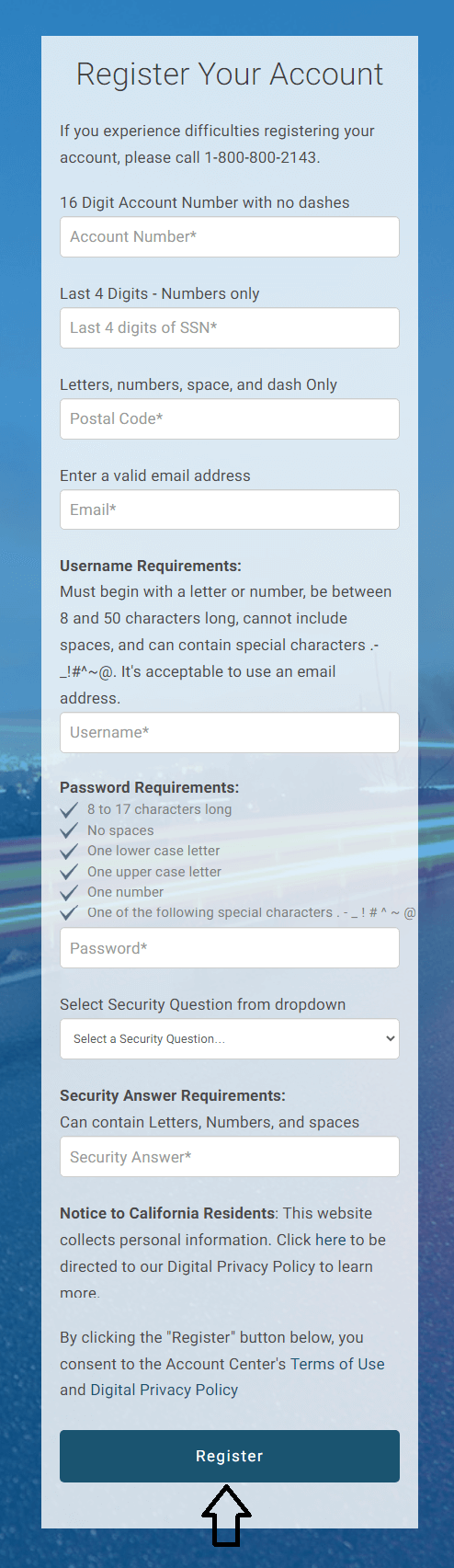

We including allow an easy task to stay on best of your financing costs. That have financial support of OCCU, you could potentially manage your mortgage from your own MyOCCU Online Cellular account.

dos. Preapproval try empowering

Among the best things to do since a purchaser was rating preapproved to own an Camper, cycle otherwise vessel financing before going feet into the a car dealership. Together with your preapproval in hand, you should understand exactly how much you really can afford to pay instead overextending your finances. Additionally enter a far greater position so you can discuss just the right rates for your buy.

step three. To invest in out-of a dealership

Make use of your OCCU preapproval to find and you will complete the funding correct at dealer. OCCU partners with hundreds Camper, boat, and motorsport dealerships throughout Oregon, Arizona, and you can Idaho; just find the new CUDL icon or ask your specialist if he or she is good CUDL agent. In that case, you are able to the OCCU preapproval to do loan places Trussville the entire deal at once. You can start likely to our very own OCCU agent couples by going to so it webpage.

4. Many years things

To purchase good preowned automobile can also be hit thousands of dollars off of the car or truck, but it doesn’t always help you save money ultimately. Many years and mileage is also both affect the interest in your bicycle, vessel otherwise Camper mortgage. As apr are large on the old automobile and you can vessels, definitely assess the complete rates (that have desire included) before deciding. Or confer with your loan officer about which option helps you to save you the most currency.

5. Your credit score can provide you with an improve

Once you buy an auto, your credit rating commonly identifies what type of loan you are qualified to have, simply how much you might use and you will what your rate of interest have a tendency to be. The same is valid with a yacht, cycle otherwise Rv financing. The better you could enhance your credit rating before you apply, the greater amount of you could potentially save very well appeal.

6. There might be a taxation break in they to you

We are really not right here to present taxation suggestions, but i do suggest inquiring your own income tax top-notch in case your watercraft otherwise Camper might qualify as the another home, potentially generating you federal taxation breaks predicated on the loan interest. Consult a taxation agent to learn more.

You can not lay an expense to your leisure and you can stress relief, you could reduce the Camper, bicycle otherwise motorboat loan. Speak about our recreation vehicles mortgage choices to learn more about how OCCU helps you get out and you will discuss the locations.