For people who query some body how much money they generate into the an effective few days (which, i recognize, could well be most impolite!) very could leave you a specific number.

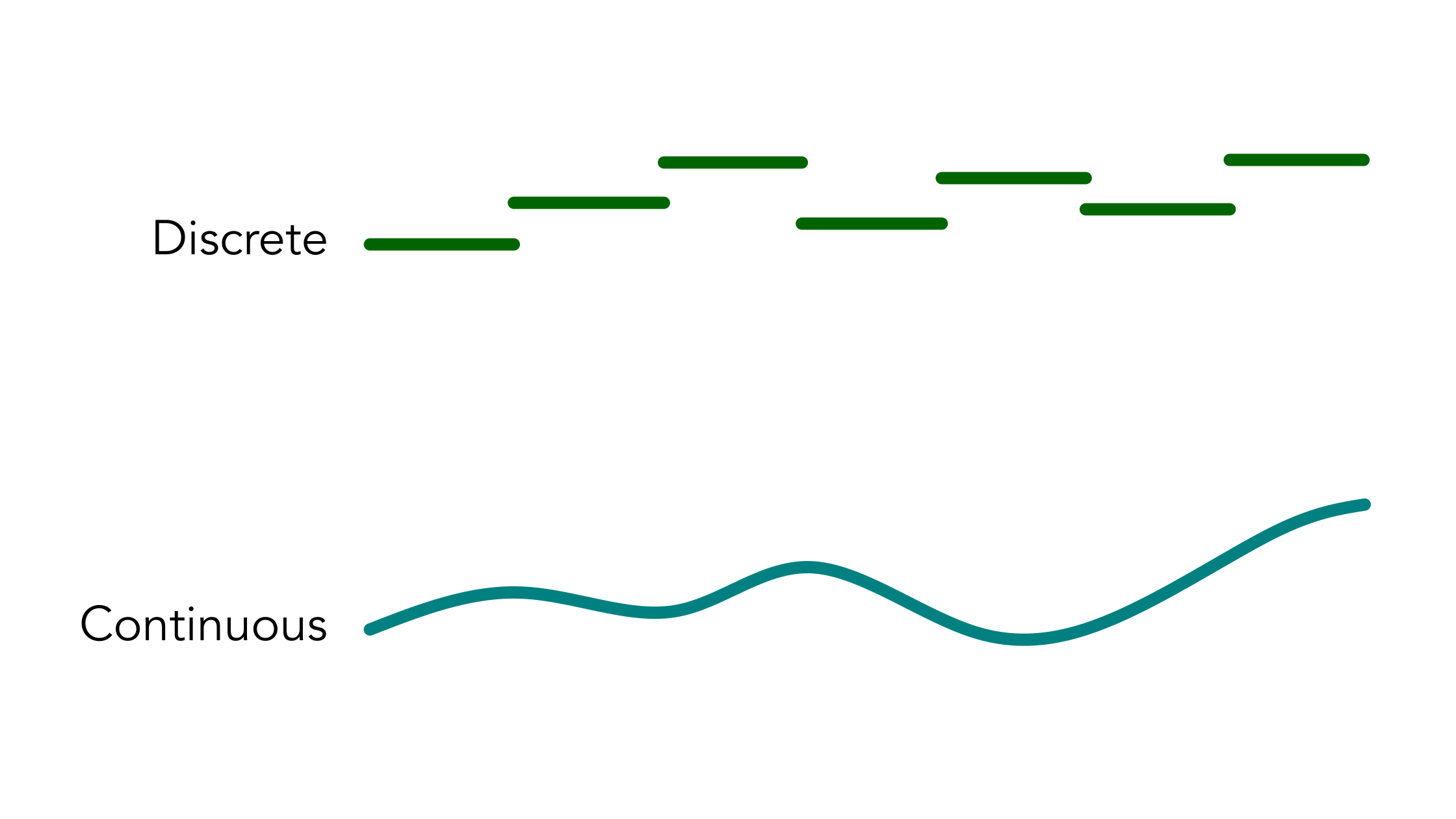

Self-operating and you can payment-established telemarketers are a couple of examples of gurus having inconsistent revenue. They could earn a fortune, but the income will not disperse at a regular basis. They could has actually a flash flood of money when you look at the Oct, upcoming look for an excellent trickling earnings from inside the November.

But what performs this suggest whenever getting a mortgage? Sadly, extremely finance was created, no less than partly, in your regular income. Whenever you can prove that you earn precisely $1,five-hundred weekly, including, the lender can use this informative article to obtain approved. But not, for those who put $dos,800 7 days and you may $two hundred next, it may be hard to find approved.

How to get a home loan With a contradictory Money

To find recognized for a mortgage loan in the place of a regular earnings, you just need to prepare your cash, organize your articles, and maintain duty with your funds. Try this advice, and you can get home financing in the place of a normal money.

Self-Functioning Consumers Will most likely You want A couple Years’ Experience

On the subject of business owners and you can worry about-operating somebody, you’ll likely find that the lender means that possess about 2 yrs regarding suffered experience in the organization so you can initiate the loan process. If you have couple of years sense you are, mathematically talking, more likely to create ultimately. Two years is seen as a limit, assuming you might arrived at that it draw (or already have) you’ll be very likely to become accepted. That it a couple-year draw was maintained because of the Federal national mortgage association and other establishments.

Talk to your Bank on a bank-Declaration Home loan

A bank-report loan is basically home financing that utilizes bank comments so you can create degree. This type of loans can be extremely productive for many who wanted a large financing over the conditions put by extremely authorities lenders, or need meet the requirements using an inconsistent income. People can not be certain that their money playing with traditional means, therefore a financial declaration, which will show dumps, withdrawals, and balance numbers, will help lenders see whenever as well as how you have made repaid, as well as how far.

Cut getting a huge Down-payment

The greater amount of of a down-payment you might promote, the better your chances for being acknowledged to possess a mortgage when you yourself have an inconsistent income. Loan providers like to see a big down payment for almost all causes. First, it reveals what you can do to keep and keep responsible financial activities. Anyway, while you are responsible adequate to save yourself a deposit, you are probably in control sufficient to make the home loan repayments. An advance payment together with minimises your financing-to-really worth proportion, that’s a significant factor to possess lenders.

Include Your credit rating

For everyone consumers, the financing score is a crucial part away from loan approval, however for people that don’t have a normal income, its certainly important. Definitely maintain a powerful borrowing from the bank reputation by making timely repayments, keepin constantly your debt load down, and you can overseeing their borrowing from the bank to have discrepancies. With diligence and you can responsible investing, you could replace your credit history and sustain it within an excellent height that produces you more desirable to help you lenders.

Provide normally Monetary Information that you could

Whenever you are normal group possess a clear-reduce road to indicating the income, you will have to do some way more work to carry out. Take the time to inform your financial on your own business’ earnings, expenditures, and you can revenue and you will raise your probability of approval. In short, lenders such as for example guidance, so if you will offer him or her monetary suggestions of the team, it will certainly assist.

It’s also possible to need to educate your own financial into the characteristics of your own providers. When you yourself have another company, enable them to know very well what you will do, the method that you get it done, and just how you create money. This post increases their depend on on your ability to pay-off the loan.

Alter your DTI

The debt-to-earnings ratio the most secrets to have lenders, and another of the most uniform predictors having credit chance. So it ratio (that’s in fact authored since a share) tells lenders simply how Delta Ohio personal loans much your debt within the monthly installments compared to the exactly how much you earn. For example, for many who secure $4,one hundred thousand a month and get $step 1,000 inside the repayments, their DTI is twenty five%. ($step 1,000 was twenty five% out of $cuatro,000.) The better the brand new fee, the greater chance there was so you’re able to loan providers.

If at all possible, decrease your DTI by detatching personal debt and you can keeping your credit balance as low as you’ll be able to. Settling handmade cards, car loans, and you will figuratively speaking (preferably) will greatly reduce their DTI and then make your more appealing to help you lenders, while you own a corporate or earn income.

Explore All your valuable Earnings Source, Not only Your task or Organization

Most people ignore you to definitely income will not only come from an effective nine-5 jobs. There are many income source that you might be able for certification, as well as funding money. To use funding income, you will probably need to have shown earlier repayments and gives files one be sure the main cause. You can also have fun with senior years earnings, such as Societal Safeguards and you may retirement benefits, otherwise supplementary earnings, such as for example area-time functions and you can front companies, to boost your chances of recognition.

Rating a page from your Employer

Finally, for many who work at payment, you need to get a page from the workplace one says the character of one’s functions. A work letter will help a lender see your career and you will income, even though they’re used in normal salary or salary team, they may be able be also ideal for payment-dependent a job. The newest page should include the ft paycheck, nature off a career, and you may money for around the past seasons.

Common-Feel Lending for folks who Lack a typical Money

If you make a living, you are entitled to the best take to at the a mortgage loan ! Contact the team in the Hillcrest Purchase Financing and we will assist the thing is the proper financing for the specific means. Let us play with the preferred-sense method to credit to boost your chances of approval!